-

Contact Us

Contact Us -

Re order

Re order -

Log in

Log in -

Cart 0

Cart 0 You have no items in your shopping cart.

- Printed Checks Frequently Asked questions

Still have questions? Ask Us

When can I expect to receive my checks?

Custom products require 3-5 business days for production unless a rush has been selected. Our speedy systems move your product out the doors as quickly as possible, ensuring timely delivery with shipping method selected as checkout.

Blank stock orders usually ship within 3-5 business days.

All non-rush orders are guaranteed to be delivered in two weeks.Can I print checks with my own logo?

Yes, Black & White logo printing is free of charge! Full color logo printing is available for an additional fee on all QuickBooks & Computer checks. It is important that the artwork be sharp, preferably in black ink on a white background (for bw logos) and saved as a PDF or JPG file type. The quality of your printed logo will depend on the original artwork you submit online.

Do you provide samples of checks prior to fulfillment?

Yes, when placing your order, write us a note in the comment section requesting to see your‘proof’ prior to shipment. A PDF proof will be uploaded in your account. The order will be processed as soon as you approve the design.

NOTE: Emailing samples for approval, may delay the processing time. Don’t forget to approve right away to ensure our shipping deadline is met. Checkomatic does not assume responsibility for delays due to unapproved or rejected proofs.How do I know my routing #, MICR #, Account #, etc.?

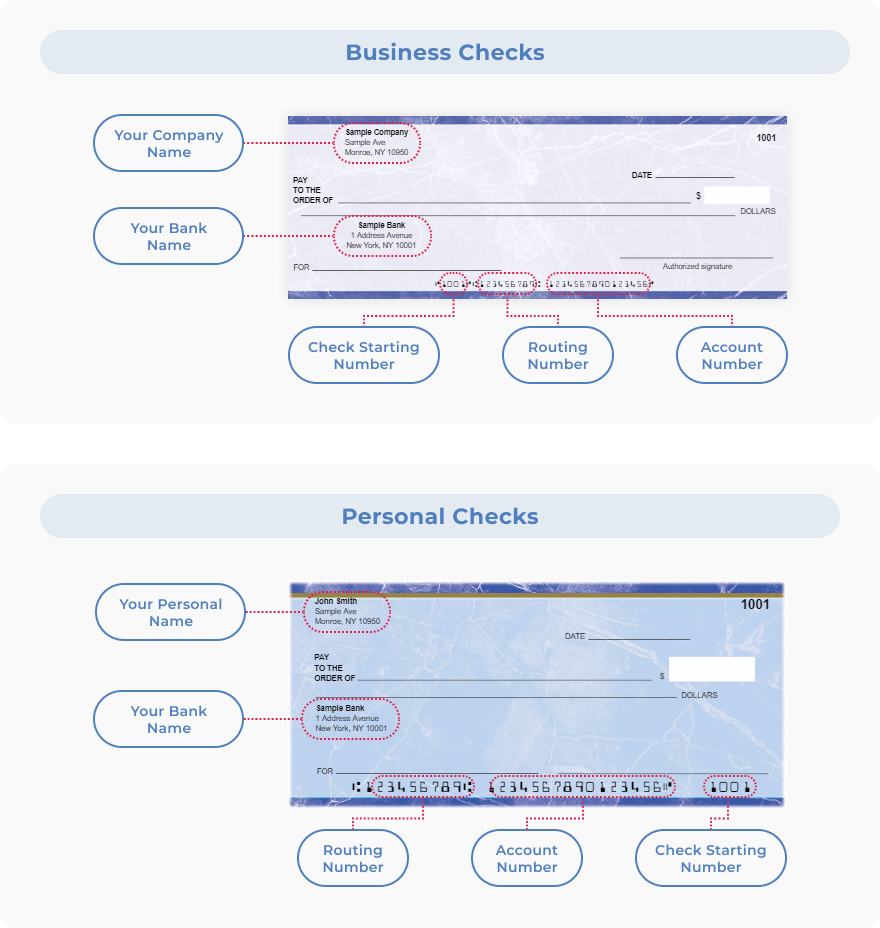

You can find your routing number, MICR number, and account number on a paper check:

Routing Number: Look at the bottom left corner of your check for the first set of nine digits.

Account Number: Just to the right of the routing number, you'll find your account number, which may be 10-12 digits long.

MICR Number: The MICR line includes both the routing and account numbers, along with the check number, and is found at the bottom of the check.

Always ensure to use an authentic check issued by your bank, and contact your bank directly if you have any doubts or questions.

Please consult the helpful diagram below to locate your information.

These are the area’s of a check that contain the most important information. You will need to supply your Bank and business names, addresses, the MICR#, Transit#, Account#, and Routing# when ordering your checks. Please consider printing this page for future reference (highly recommended if this is your first time ordering online).Do you take orders by phone or email?

Unfortunately, we are unable to take orders by phone or email. To guarantee swift processing and shipment, all orders must be placed online. If you are having trouble navigating our site, feel free to contact us during customer service hours, and a helpful representative will walk you through the process via phone or chat.

All your information will be stored safely in your online account for future quick reordering. Online ordering will enable you to get order updates and tracking numbersWhat is the difference between 1 check per page and 3 checks per page?

Business customers with payroll and accounts payable typically use the 1-per-page style.This includes check on top, check in middle or check on bottom, depending on the specific software you use.

Home users generally use the 3-per-page style, which cuts paper waste and is more efficient when you’re writing checks in bulk.Do the checks have security features?

Yes, absolutely! Our checks are designed with a variety of security features to ensure the utmost protection. Here's a list of our standard features:

Check-21 Compliance: Ensures that the checks meet the requirements of the Check Clearing for the 21st Century Act, allowing them to be processed electronically.

Security Features Box: A designated area on the check that outlines the specific security features included, providing easy verification.

Coin Reactive Ink: An ink that reveals a hidden image or symbol when rubbed with a coin, offering an additional layer of authentication.

Erasure Highlighting: Changes in the appearance of the check's surface when an attempt is made to alter or erase the handwritten information, making tampering evident.

Front Security Warning: A clear warning on the front of the check that outlines its security features, deterring potential counterfeiters.

Micro-Printed Border: Utilizes tiny text that is readable under magnification but blurs when scanned or photocopied, making replication difficult.

Artificial Watermark: A printed feature that simulates a traditional watermark, visible from an angle, to enhance protection against duplication.

"Void" When Copied: The word "VOID" appears on copies of the check, alerting recipients to potential fraud if they receive a photocopied version.

For those who require enhanced protection, our high-security option includes additional features:

Heat Sensitive Ink: Ink that reacts to heat by changing color or disappearing, offering quick verification of a check's authenticity.

Two Colored Background: Utilizes two contrasting background colors, making alterations and forgeries more visible.

Endorsement Area Pattern: A specific pattern in the endorsement area that protects against unauthorized endorsements or alterations in this critical part of the check.

Endorsement Area Seal: Additional seal or marking in the endorsement area, providing another layer of security against tampering.

Colored Signature Area: A specially colored area for signatures that helps in visually verifying the authenticity of the signer's hand.

These features, especially when used in combination, provide a strong defense against check fraud and counterfeiting. Standard features offer solid protection for general use, while the high-security option delivers enhanced safeguards for those with specific needs or concerns about security.

By choosing checks with these features, individuals and businesses can operate with greater confidence and peace of mind.Are other custom features available?

If your check requires features or customization that is not listed online, feel free to contact us. We will try our best to accommodate your request.

Do I need reverse numbering?

If you feed your checks face down and the printer takes the top check first, you might need reverse orientation. See the diagram below.

Do I need to mail a voided check?

In most cases, no. If this is necessary, we will contact you right away.

How can I make sure my new checks match my bank’s specifications?

Our checks are guaranteed to match all banks specifications. If you are still unsure you can email your specs to [email protected]. Put your order number in the subject line; we will set up your checks accordingly.

Can you send me physical samples of checks?

Yes. Please email us at [email protected] and include your mailing address along with the items you are interested in and we will be happy to assist.

What payment methods do you accept?

Checkomatic accepts all major credit cards. First check payment option is available for all printed check orders. (The first check of the batch will be physically deposited)

Do you charge sales tax?

Sales tax is only collected if you are ordering in the state of New York. If you are tax exempt,create an online account & email your Tax-Exempt form to [email protected] before your order is submitted and we will set up your account as tax exempt for all future orders.

Check Security Features

Accepted by the world’s leading banks