-

Contact Us

Contact Us -

Re order

Re order -

Log in

Log in -

Cart 0

Cart 0 You have no items in your shopping cart.

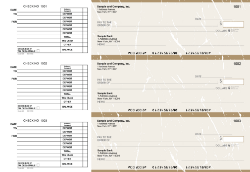

Check Writing and Cashing - Everything You Need to Know About Your Checking Transactions

![]()

Checks are in use for several purposes, be it for business or personal work. You may also need to use this financial instrument for various transactions. What is check writing? Are you aware of the basics of check writing? Which are the specific requisites that should be part of a check? What does writing bad checks mean?

When opting for this instrument for your financial transactions, you should know its usage and the potential risk involved. While the checks are very convenient to use, anyone can liquidate them into cash.

You can find the most security checks here at Check O Matic

- Many Security Features

- 20 Color options!

- Add your company logo in black n white - FREE! ( Full color option available )

- Compatible with laser or inkjet printers. Software required

- Many Security Features

- 20 Color options!

- Add your company logo in black n white - FREE! ( Full color option available )

- Compatible with laser or inkjet printers. Software required

- Many Security Features

- 20 Color options!

- Add your company logo in black n white - FREE! ( Full color option available )

- Compatible with laser or inkjet printers. Software required

- Many Security Features

- 20 Color options!

- Add your company logo in black n white - FREE! (Full color option available)

- Compatible with laser or inkjet printers. Software required

- Premium quality checks for writing

- Accounts payable stubs for record keeping

- Checks punched - to fit a 7 ring binder (binder sold separately)

- Available in singles & duplicates

- Premium quality checks for writing

- Business payroll stubs for record keeping

- Checks punched - to fit a 7 ring binder (binder sold separately)

- Available in singles & duplicates

More than 10 billion checks are in use today to carry out various financial transactions globally.

How to Write a Check?

![]()

How to correct a mistake made when writing a check? What is considered writing a bad check? While reading the above, you may be wondering what you can write in a check. Though such an instance is very rare, for someone to enquire about such an aspect is completely okay, and you need not feel ashamed of it.

When correcting a mistake on a check, you can use a blue or black pen to cross the wrong words or digits neatly with a single line. Such mistakes can include the wrong date, misspelled name, or wrong amount. You should avoid scribbling on the check to cover up the mistake.

People often have questions like ‘Does writing checks build credit?’ or ‘How to check your writing?’ You can follow a few simple steps while writing a check for your business or personal use. When writing a check amount in words or putting the details in the payee line, you should be mindful of a few aspects.

Also, writing a check to cash is not a great idea, but it is the ultimate decision of the person who is writing it. They need to take a call whether they want to go ahead with it or not.

Even in this Digital Era, approximately 7% of all transactions happen through checks in the US.

If you are planning to write a check to cash, how to practice writing checks that would work. It is easy as you already must have imagined in your mind, but here’s what you need to follow step-by-step while writing a check. Of course, you can order computer checks that can be printed using accounting software. However, you will still need to be mindful of these basic components of check.

Put a Date on the Check

When writing a check, the first step that you start with is dating the check. As per the format recognized across the world, the top right corner has a section for the date. The date is generally abbreviated as per month, day, and year, in the format of MM/DD/YYYY.

Put the Payee Details

The second step of writing a check involves putting the details of the recipient. It is in the line labeled as ‘Pay to the Order of’. You can mention the word ‘Cash’ on this line for your check payable to cash. It is a crucial step for writing checks from a trust account or any account that deals with an establishment that has the integrity to maintain.

Writing for deposit only on a check can be a step if you are looking for your recipient to encash the check through bank deposit only.

Put the Check Amount in Numbers

![]()

The third step of the check writing process includes mentioning the amount of the check or the value that you are planning to transact in numbers. It is to be in the box that has a $ sign next to it. As the $ is already present, you just need to put the numbers using numerics as per the amount. It is important to ensure that the numbers you mention on the check are legible and do not have any overwriting.

Ensuring that the numbers you put in the check to be in place properly makes the life of the recipient easier when they visit their nearest check cashing. For example, if you are planning to write a check payable to cash of $ 1500, you mention 1500 in the specific box only.

Put the Check Amount in Words

In this step of the series ‘What are the steps for writing a check’, you will understand the need for writing the check amount in words. These details will be on the line that is below the ‘Pay to the Order of’ line, where you will see a blank line that ends in dollars.

For our above example of writing a cash check of $ 1500, you will write ‘fifteen hundred’, followed by a strike to avoid any changes in the check amount. Good check writing will adhere to the family dollar check writing policy. You can choose to use a writing checker tool or a Quicken/Quickbook check writing software to improve your overall check-writing experience.

If you are looking for a more secure and precise writing technique of checks and reduce the likelihood of tampering by anyone you can put an additional aspect in play. You can write ‘fifteen hundred and no/100’ on the check. It indicates that the check is for $ 1500 only and no cents. However, even if you are putting this particular articulation in place, you should still strike out the rest of the line and not leave it blank ever.

![]()

Put the Details in a Memo or for Field

The person, who receives the check or as banks identify them as recipients, can request you to add a few specific information to the check. You can mention these details in the ‘for’ or ‘memo’ field of the check. This field is towards the bottom left corner of a check.

It may happen that the recipient of the check, who is receiving the money from you, does not mention or request any additional information. Under this scenario, you can use this space to put up any information to remind you of the reason you wrote the check. The recipient of the check can use friendly check cashing or mobile check cashing processes to encash the check.

The advancement in technology and the dependence on online search engines have led to behavior change to scout for a particular service. We tend to use online platforms to seek a resolution to our queries. You can also use such platforms to put up a query like ‘who cashes checks near me’ or ‘cash check online now’. Such cases are changing the services that were earlier available only by the traditional means.

Put Your Signature

![]()

The final and the most crucial step of the entire check writing process is signing the check. The right-hand corner of a check is specifically allocated for your signature. When you put your signature on the check it means you are endorsing all the information that is in the check.

Therefore, it is vital to validate all the information you put in the check before signing it finally. The bank considers the check to be valid if the signature that you put on the check matches with the copy of your signature present in their records.

Other Relevant Information

Check Number - The check number is the shortest set of numbers that you find on a check. These are usually the last set of numbers of your personal check. The check number is vital for tracking the particular check that you are writing. You can also find the check number on the top right-hand corner of the check.

Routing Number - The routing number on the check helps to identify the location of the account. It is one of the three sets of numbers mentioned at the bottom of the check.

Padlock Icon - The presence of enhanced security features like the padlock icon helps to indicate to all the parties who deal with the check that an additional level of security is part of the check’s design, materials used, or the production process.

How to Cash a Check?

While writing a check, it is not always crucial to have the recipient's name. You can mention 'Cash' in the line (Pay to the Order Of) that has the payee’s name. Such checks are payable to cash.

Since such a check does not have the name of an individual or company, a person who possesses it can encash or deposit the check. While writing a check to cash, it is essential to list the recipient of the funds, although most of them go to a specific payee. This step makes a check as a financial instrument safer than cash as it only allows the person whose name is on the check to deposit or handle it.

While pursuing savings account check writing payable to a ‘Bearer’, it works the same way as writing a check to yourself. If you are the bearer of the check and wondering, ‘Where can I cash my check?’, then you should know any person who holds this instrument can encash it.

Check and Cash

Assuming the issue to check does not bound then a check payable to cash is more or less similar to cash. You can look for a check cashing place near you and redeem the same. In case of a scenario where the check gets lost, the person who finds it can encash it unless the stop check request is in place. Also, the recipient can forward the check to anybody else.

![]()

Need for Check to Cash

There are various reasons for choosing to use a check to cash. Let us look at them in detail.

Consumers used cash in 26% of transactions in the US.

Payee Unknown

When you are unaware of who encashes the checks, opting for a check payable to cash can be a great solution. The recipient of the check can later opt for a check cashing service to get the money.

Let us say you are to pay a particular amount to any individual, but you are unaware of the payee’s legal or exact name. Under such circumstances, you may choose to write a check to cash and carry it to deliver to the person to whom the payment is due.

Or say you are paying money to your new landlord for the first month of tenancy, if you are unaware of the exact name, you can choose to write cash and send it to him. Many people leave the check blank, which allows the recipient of the check to write their name after they receive it.

However, for any reason, if such a check reaches someone else, that recipient can then cash them too.

Self Withdrawal

You can choose to use a check if you are planning to withdraw cash for yourself. You can mention ‘Cash’ in the line which has the payee’s name while writing a personal check. However, if you are planning to withdraw money for yourself, you can choose other means too.

What Can Be a Bad Check Writing Practice?

Writing a check payable to cash has too many risks involved than the convenience, which most people often seek. Let us look at a few complexities that can stem from such a bad check writing practice.

Threat of Loss

![]()

Since you do not have any control when writing a check out to cash, it is best to avoid such a practice. Under such a scenario, you do not have any control over who cashes or deposits the check.

In the event of a check getting stolen or lost, you will have to take steps to prohibit its misuse by monitoring the transactions with the bank. You may have to pursue the legal route if you are not able to get hold of it in time. Legal action may be set in motion against the depositor who undertakes such a fraudulent transaction.

Check frauds comprise 35% of bank frauds. Every year around 500 million checks get forged. Such an act leads to a cumulative loss of $ 10 billion annually.

It often happens that many people opt for the services of banking institutions to print and send their checks via mail. Such acts can increase the possibility of loss or theft significantly.

Skeptical Banks

Another reason why you can avoid writing out a check payable to cash is many of the banking institutions do not honor them. Some of the banks even have stringent policies where one cannot cash a check without an ID. Showcasing a valid photo ID is necessary to redeem a check payable to cash.

Banks have the liberty to refuse such checks or hold the funds for a longer period. Can I cash a check at any bank? If you are wondering the same, you should know that the banks can also refuse official checks payable to cash.

Let us say, for example, you are planning to make a high-value purchase from someone you do not know. Banks will not be keen to issue a cashier’s check unless you give them the specific name of the payee.

Tracking Papers

In the absence of a payee’s name on the check, it becomes difficult to keep track of the transactions and document them. However, you will still be able to keep note of all your expenses. But the presence of a payee’s name helps to ease the financial process. When you have a payee’s name on the check, the need for checking the signatory’s identity or tracking the money will not be necessary.

Solutions

You can choose to leave the payee line blank for the time being instead of writing a check that anyone can encash. Once you have the details for proper check writing, you can put the name of the payee. However, if your check writing format has a blank payee line, it is the same as a check payable to cash. Although, it is vital to note that the imposter's handwriting may not match yours in the first instance.

When writing a check do you sign the back? Another option can be to issue a check in favor of yourself, and once you have the right payee, you sign the back of the check and hand it over. It can be a more secure method, but at times banks can reject such checks. Under such a scenario, you will need to start the process all over again.

Can You Cash a Check at Any Bank?

The encashment process of checks payable to cash is similar to any other check. Once you receive such a check, you can deposit it after inquiring about places to cash checks. Alternatively, you can deposit the said check to your bank or credit union by mentioning your account details on the back of the check and putting a signature as your endorsement or using an endorsement stamp.

If you are far-off from your home branch, you can mention the details of your account on it and drop the check at any of the nearest branches. If you need cash, you can look for the ‘24-hour check cashing near me’ on the Internet.

A crucial aspect that you should keep in mind is that the banks can hold the checks payable to cash for a long period or refuse to pay them. Therefore, you should make sure whenever you receive any checks, request the sender to mention your business or your name on them. This step will ensure an effortless payment process of your checks.

You can choose to provide simple instructions to those who are writing the checks. You can also inform them of what is in consideration for writing a bad check. These steps will ensure that the person writing the checks does not pursue the temptation of taking any shortcuts.

Availability of Funds

Writing a check to someone is an easy way to carry out financial transactions. It allows you to get rid of carrying cash in your pocket or pay additional charges for a wire transfer to get funds to another bank. However, you should never treat it as a source to create money for yourself.

![]()

You need to be sure that your bank account will have funds when the recipient presents a check for clearance. The recipient bank may accept the check and make the funds available to your account. However, eventually, when the check bounces, you will attract a penalty as well as legal trouble for writing bad checks.

It is also crucial to note when you maintain an account with a low account balance, additional low-balance charges can apply. If you check the popular search engine results you will find people putting up queries like ‘How much does Walmart charge to cash a check?’, but no one delves into the details of bank charges for check bounces.

Is Writing a Bad Check a Felony?

A crucial aspect that people who are using checks should keep in mind is if you indulge in writing a bad check unknowingly it is an act of check fraud. Such practices are punishable by law, and it is a crime to write a bad check.

![]()

Is writing a check on a closed account a felony? Is writing a bad check in Illinois a felony? Is writing a bad check illegal? You may often have come across such questions on various online platforms. If you are also pondering over the same, you should know that the penalties for such acts can vary by state. People tendering checks for accounts with insufficient balance are most often subjected to legal proceedings.

Some state laws suggest that the person who indulges in such fraudulent practices needs to cite the intent for the fraud. However, the majority of the states treat this crime as a misdemeanor. Also, it is crucial to note that if the amount mentioned on the check exceeds a particular threshold limit, the crime will be a felony.

Civil penalties shall apply across all such cases of fraudulent behavior. It is common to have a penalty amount that is equivalent to the value of the check, the check amount plus the court proceedings fees, or the multiple of the check amount with a cap.

Closing an Account?

It often happens that people who want to close a particular account tend to write the check of the unwanted account to empty it. But in practice, you should take a few additional steps apart from merely emptying your account. It is crucial that you make it official and inform the bank authorities about such a step and carry on the job accordingly.

![]()

You can ask your bank to close your account that you operate with them to avoid the bank account being open indefinitely. With the advancements in technology and customer service, banks allow a seamless process for their customers to either send applications for closure through offline mail or make online requests.

By pursuing the appropriate steps to either switching your bank account or simply closing, you can be worry-free too. It often happens that some of the accounts may have pending charges, choosing to settle such charges can help you avoid any future concerns. You can choose to pursue simple steps to undergo this process:

Identify a new bank

Find time to review and transfer all the automatic payments set to your old account also take note of the recurring transactions and inform the payees accordingly,

Initiate a transfer of funds from your erstwhile bank to the new one

Inform your old bank about the closure of the account through a written letter of request or online application forms.

Instant Online Check Cashing Options

Can you deposit a paper check on the cash app? You can easily get an online check cashing option in today’s digital world. There are various check cashing options on the internet today that enable users to cash their checks wherever and whenever they want.

It often happens that most people like to have their checks cashed instantly. Also, some people need to encash checks that they receive from various sources. With their different sources of income, they all have the intention to be able to invest the money once again as soon as they receive it.

It often happens that some think that checks are obsolete. In the circumstances where you have several income sources, you may have some of the checks lying around.

How to cash a check without an id? The online apps, once registered, do not ask for your ID again and again, and you can encash your cheques easily. When you get the payment for a check easily, you can quickly get immediate access to your funds with online check caching services.

It is one of the most convenient and fastest ways to get your money in your hand without having to visit a bank or a check-cashing store. There are plenty of options to use if you need cash personal checks in person. You can choose to use online apps that help to track your account to see whether your account has all the credits from your various income sources.

Where Can I Cash a Cashier’s Check?

We all know several means to encash checks through a bank deposit or cashing store. If you are looking for such a place, you can choose to search on the web using ‘Where can I cash a check near me?’ However, with the increase of the digital space availability of the options on the smartphone, the process of depositing checks has become so fast.

![]()

You can easily use the downloadable and cash your check instantly. A crucial aspect to note is that the majority of such instant online check cashing services need you to link the bank account with them during the first transaction.

Several such apps also require you to write the abbreviation ODO or online deposit only below the check. The app also requires you to take pictures of the front leaf of the cheque as well as its back while submitting for encashment. You can choose to use any phone that has a camera or a smartphone to take these photos and upload them effortlessly.

How Does the Online Process Work?

After the user clicks a photo of the check, the check then goes for approval to a queue. The money will get deposited into an account that you choose to map earlier with the app once the check gets cleared. Such an account can be of your bank or a prepaid card that you often use, among other modes of transactions.

If your app is linked to another account, then it will require an additional step. In the subsequent step, you will need to transfer the inbound money to the requisite bank account or to a place where you want it to be. In most cases, you will need to keep the paper checks safely for at least 14 days or till the time the transaction is complete and confirmed. You can then shred the paper version to avoid any financial security breach that can arise from such a paper in the future.

Various banks across the USA offer services that include online check-cashing. While opening an account in the bank, you can check if the preferred bank has such a feature or not. The presence of such a beneficial attribute allows you to make use of the online check cashing services. The condition being you have to have an account with them.

You may also choose to use the apps that are available today which help to monitor your deposits in the bank account, like Personal Capital. The app has a clear interface that helps showcase the cash flow dashboards that allow monitoring of the inflow of income.

How to Encash a Check Online?

![]()

If you are planning to encash the check online, you can follow a very simple process by using your phone and a few applications. As a first step of ‘How to cash a cashier's check online?’, you should opt for a mobile phone that has a usable camera. This step is specifically important as it will need to scan your checks on the go.

There are several online checks cashing applications that you can consider, which are either backed by a large institution or work independently. Most of these online check cashing services offer both online and in-person free services. You can refer to the below list of routing numbers for large institutional banks which help provide such services:

US Bank Routing Number

Wells Fargo Routing Number

Chase Bank Routing Number

Check Cashing Online Services

Modern times call for modern solutions. Therefore, in today’s age, encashing checks should happen without the need to step out of your office or home. Some of the popular online check encashing apps are also provided by your local banks. The online check-cashing applications are convenient and can help you to free up your time instantly. Nobody enjoys running errands.

Some of the popular online caching options that provide an instant solution that can be part of your considerations set are:

Bank of Internet

This app allows you to encash your check online and also deposit funds into your savings account. The Bank of Internet app also allows you to use a checking account as well. It is available on both App Store and Google play store.

The app allows you to carry out the process of check encashment through a very simple process. You need to simply put up the pictures of the front and back of your check on the app. The app maps your bank account previously and therefore the details of your check are easily shared with the same. This service is completely free and to avail of the same, you just need to open an account with them.

PayPal App

PayPal is a company that everyone knows. The payment giant allows check encashment through their mobile app. The app is available on both the Google play store and the App Store. The trust and the confidence that PayPal brings along with it helps most people to come onboard.

![]()

To encash your check online instantly, you need to visit ‘My Account’ and take photos of both your front and backside of the check. Their service is completely free and they do not charge any fees for such encashment. However, you should note that there is a $ 1000 per day limit and it takes around 2 to 3 business days to process the checks. It is a very popular and well-known check cashing and is found to be very helpful. It also helps in other money transferring processes as well.

Large National Banks

The most well-known and the lowest cost option that is available in the market for instant online check cashing is by the larger national bank. Over the years there are a large number of banks that allow instant encashment of checks online. A very crucial aspect to note here is that the banks need to be more tech-savvy and adapt to the changing needs of the market to cater to the evolving demographic needs.

![]()

The only issue that you can face for such services is that to avail it, you need to be an existing customer of theirs. You can find a list below of banks, both large and national that allow instant deposits and ease the process of check encashment for you:

Bank of America

Chase Bank

Wells Fargo

US Bank

Chase bank has become one of the most preferred choices by many tech-savvy individuals as it allows the funds to be available on the next business day if the deposit happens before 11 PM EST. There may be delays in the encashment if the check is not properly uploaded into the system.

However, for the rest of the banks, the process of depositing checks online is the same. You may also note that being a member or account holder of the bank is a necessary criterion for whichever bank you opt for availing of such services. The best part of such a service by the larger national bank is that they are completely free, and allow instant access to your money.

How to Order a Check?

There are various ways you can choose to order your check from the bank or other institutions. You can reach out to your bank’s premises to demand a checkbook or use their phone banking services to apply for the same. You can also avail yourself of the same through the website of the bank or other financial institution. There are also companies that can help get your custom checks or manual checks for business printed just the way you want.

How to Endorse a Check?

A check endorsement adds a level of security to the transaction using checks. It implies that the check-in use is for the recipient who endorses it. This step is set in action when you receive a check from someone and plan to encash or deposit the same in your account.

In general, check endorsement happens by signing the back of the check. You may find some of the checks to have a line ‘Endorse Here’ where you can put your signature. An additional line may also be present in the check, which says ‘Do not write, stamp or sign below this line.’ It is usually to demark the space that the bank requires to process the check.

Blank Endorsement

When you choose to sign the back of a check, it is called a blank endorsement. It is one of the most prevalent methods of check endorsement. You will have to inform the teller whether you want to deposit or encash the check since there are no additional instructions added to the check. However, this method is less secure as one signed anyone can encash the same.

Secure Endorsement

You can add a line ‘For Deposit Only to the Account Number XXXX.’ Such a piece of information helps the bank with the knowledge and makes the transaction more secure. After that, you can sign your name in the designated endorsement area.

![]()

Third-Party Endorsement

When you want to make a third party payment with a check that you have received from someone, you can endorse the check by mentioning ‘Pay to the order of [Name of the third party payee]’.After that, you can sign your name in the designated endorsement area.

Mobile Deposit Endorsement

Some financial institutions and banks put an additional layer of security whereby you can add a line ‘For Mobile Deposit To [Bank Name]’ for the mobile check deposits. You can find such information in your bank’s mobile app before choosing to deposit the check.

Business Endorsement

Checks that are in use for businesses require the signature of authorized personnel from the company. The endorsement includes:

Name of the business

Any added instructions like ‘For Deposit Only’

Signature

The job title of the person signing the check within the company

What Is a Post-Dated Check?

When you write a check with a future date, it is a post-dated check. Such checks can only be put into action on a particular date in the future, as mentioned on it. Such an act deters the recipient from cashing the check at a prior date when the issuer may not have the appropriate balance in their account. It also acts as a tool for security and assurance as a post-dated check proved to be a binding contract between the two parties to ascertain payment on a future date.

So to summarise, it is vital to check for mistakes in writing while using such financial instruments for your various purposes. You can make use of various online check writing services to check your writing level online.

So next time when you are writing a check for 1500 $, make sure to include the above aspects in your check and try to abide by them. You can be mindful of the various factors relating to check writing and to encash. You may choose to use automated check writing or excel check writing template for your check writing too.

Accepted by the world’s leading banks