When it comes to running a business, there are some office items every business owner must keep in stock. One of those necessary items includes business checks.At Checkomatic, we’ve got just what you need - business checks. Suitable for a wide range of payments, including accounts payable and payroll, our business checks will keep your accounting department running smoothly.

-

Contact Us

Contact Us -

Re order

Re order -

Log in

Log in -

Cart 0

Cart 0 You have no items in your shopping cart.

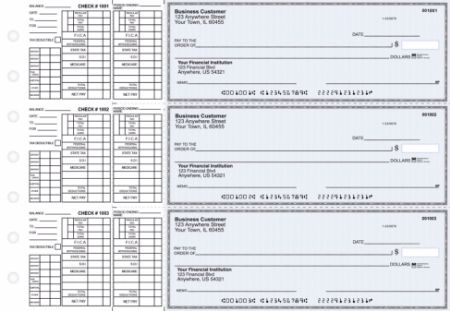

Business Checks

Computer Checks

At Checkomatic, we offer a vast selection of computer checks that cater to all your business needs. These checks are perfect for streamlining processes like payments, payroll, and accounting, ensuring that your business's financial management is both efficient and secure.

Our checks are compatible with leading accounting software such as QuickBooks, Xero, MYOB, and more, making them a versatile choice for businesses of all sizes.

113 reviews

Manual Business Checks

At Checkomatic, we pride ourselves on offering high-security manual business checks designed to meet the diverse needs of organizations that prefer traditional check-writing methods. Whether you're looking for the classic three-on-a-page style or the convenience of pocket-sized checks, our range ensures top-notch security for all your financial transactions.

72 reviews

As a business owner, it’s beneficial to have the options of computer checks or handwritten manual checks. That being said, despite the check style you chose, we ensure all your business checks will be made of premium quality paper to ensure your business checks can withstand frequent office use. Each business check will also feature an array of in-built security enhancements; such as heat-sensitive ink, coin-reactive ink, and invisible fluorescent fibers.

Don’t forget to ask us to print your company logo in black and white on your business checks for free. Simply, provide us with your company name, bank account information, and a few other details to have your custom-branded business checks delivered to your doorstep as soon as the next day. And don’t forget to inquire about our generous bulk order discounts. Learn more about Business checks with custom logo here

We pride ourselves on our ability to offer the most affordable options online.

Available in various colors, styles, and formats; such as Check-on-Top, Check-in-Middle, Check-on-Bottom, and Three-on-a-Page, our business checks feature advanced security enhancements that comply with the guidelines of the American Bankers Association.

Checkomatic now offers manual and computer business checks in regular business check sizing - 12.5 x 9 -with advanced security features to protect customer personal information.

Pros of Manual Business Checks:

Handwritten option

Fit in to binder helping business owners and entrepreneurs stay organized

Created to serve small business

Perforated edges leaving stub in the binder for records

There are a few versions to select from making the order process quick and easy

Accounts Payable

Payroll

Multi-Purpose

Pros of Computer Business Checks:

Compatible with printing softwares

Pre-printed company name and bank information

Micro-printing on micro lines

All Checkomatic business checks scan well with all bank readers and tear off easily at perforated edges.

Customer Reviews for products in category Business Checks

Customer service was very helpful. I was able to complete the ordering process in a matter of about 2 minutes. Highly recommend

My order was processed very smoothly, and once order was ready i got notified right away. A repeating customer is the best review.

Quick ship and exactly as described. Thanks!

Customer service was just fantastic and the job is perfect. Thank you!

The checks came quickly, are printed perfectly, and look great. I had questions that were answered very quickly by email. What a great experience. Thanks Checkomatic!

Simple process of reorder with fast service. Thank you!

Great product, great service!

Your Website is very user friendly.

Great job efficient and fast

Checkomatic was super helpful and knowledgeable in helping me choose the checks that best suit my needs. Highly recommended!

These pocket checks are very convenient and professional!

Super easy to use... great quality!

As expected. Duplicates serve well for record keeping!

Love the thickness of these checks. Do not feel cheap at all!

Very professional. Great value.

Nice work... thanks!

Nice work... thanks!

Nice work... thanks!

Great check style! Professional look and compact!

Second order as good as first. Excellent quality. Quick turnaround. Will be back again.

Always made to order and done in a timely manner. I usually have my checks within 5-7 days from order date, our previous company was taking a month or more. Checkomatic is great to work with and work done in a timely manner. Thanks Checkomatic!!!!

CheckOMatic has consistently served our business needs for several years. They are top notch on customer service and accuracy. And they pay attention to the details when you write them comments. Can't beat the pricing for the quality they provide.

Very nice very professional looking. When people see this check it gets their attention. Visit us @ credcomanagement.com to repair your debt and increase your credit score 150 points within 60 days.

Love this company!! We have 3 small companies and I use Quickbooks for them all. CheckOMatic is my go-to for all my check needs. The paper is thick, not flimsy like other places and the security options are awesome! Also love the fact I can pay out of the account I am buying checks for - other places make me use a credit card. The website is easy to navigate, and the service is fast. Thanks so much CheckOMatic!!

I ordered these after having to switch from hand written checks and I have had not a single problem with them. I use esmartpaychecks.com to do my payroll and these are perfectly compatible. Prints out a check and 2 stubs. Will continue to reorder them for certain.

Fast service and quality

amazing service!- super fast and efficient - and great price! thanks!

Excellent Quality! Checks have great security and was able to customize to my company's needs! logo printed in color to give it the extra nice touch! Thank you,

Very professional, and easy to order

My experience with checkomatic was excellent! I recently ordered business checks and I'm very satisfied with them! Definitely recommend Checkomatic!!

Recently purchased some window envelopes for the company I work for. There was an issue placing the order. I reached out and chatted with a customer service rep, they were fantastic. There was a glitch with my order and they pushed it through for me, but due to the glitch it did show multiple orders for the same thing for me. They fixed that also and got my order out to me right away.

I must say 'WOW' to such a beautiful website! Everything is clear and neat. It makes ordering so much simpler.... Chat is quick and extremely helpful! Everyone should be using Check-O-Matic for their business supplies!!

These are good checks, I run a management business and I cut checks on behalf of my clients regularly. These checks did exactly what I used to by checks for double the price. The security features are there, no worries on that. I will be buying from here from now on, Thankfully I shopped around.

Works just perfect with my printing software! One of the best companies i've ever found!!!!!!!!!!!!!!

I am very pleased with the checks

This is the first time I have printed checks by Check-O-Matic and I couldnt be more pleased. The quality, service, and pricing are terrific!

The CheckOMatic team is fantastic! I was able to get in touch with a CS represented on the chat feature and they were able to help me though the process of customizing my business checks and was able to help with the rush order as I needed as soon as possible. I ordered the checks on Friday morning and they were delivered Monday morning! Will definitely being doing business with them again!

Check-O-Matic consistently offers the highest quality check printing out there. I recommend the High Security to all my freinds. Quick shipping and worlds above other check print shops and banks! Trust my words....

The website is easy to navigate, and I love the logo options. The finished order with my business logo in colored looks beautiful and shipped super fast!

This was the first time I ordered the manual pocket checks over the manual business checks. The quality is excellent, size is perfect, shipping was fast, and the customer service was extremely efficient!

We make a yearly purchase with Check-O-Matic for the Manual checks since we use them pretty often. We LOVE them. the quality and service are stellar! 👌

I recommend Check-O-Matic to anyone looking for professional checks at reasonable prices!

This is my FIFTH order with you guys... Doesn't that say enough??? Thank you for everything!

My order was super easy to submit! and the shipping was really fast. When my checks arrived the printing was perfect and the quality was perfect as well!

We ordered from two different companies and the quality from Check-O-Matic was so much better! We are very happy with how our computer checks on bottom turned out and will only use Check-O-Matic moving forward. Thank you again!!!!!!!!!!

I always love everything I order from Check-O-Matic. I have ordered Manual checks, business checks, envelopes and endorsement stamps. I have always been pleased and will continue to order from Check-O-Matic.

This is the 4th time that I use CheckOmatic to order checks for the company and definitively will continue doing the same...

Check O Matic checks are awesome and affordable will always use them.

I added by business logo on those and payed the extra fee for the colored printing. It absolutely paid! My checks look so professional and the logo makes it look so personalized. I love the finished touch that the colored logo gives it... Thank you!

The order was delivered in a timely manner and I am very satisfied with the quality and price. Thank you very much!

I'm more than happy to post a 5 start review! I use Check-O-Matic for all my checks and envelope orders and I have never been disappointed with my order. They deserve a 5 star rating for each and every time! They go above and beyond!! For the manual checks in particular--I always go for the Marble--I think they look much neater than the safety ones.

Thank you so much for a Quality product. I'm very happy with my checks. they work great with my software.

I LOVE those checks! My order arrived much faster than expected. I absolutely made the right choice with Check-O-Matic!

Very accurate and beautifully printed! Fits the printer perfectly. Don't hesitate in buying these checks. I couldn't be more pleased.

This product works exactly as I had hoped. The ordering process was very simple and the Live assistance was SUPERB!!! Give them a try.........

These pocket checks are a nice option over those large Manual 3 per page variety. This is so convenient and compact!

Just what I wanted and what a BARGAIN! I checked all other placed and nobody beats Check-O-Matics pricing!

Shipping was way quicker than expected. I am 100% satisfied! I am so proud every time I send a check out.

You can't beat the price of these checks!!!!!!!!!!!!!!!!!!!!!! I’ll NEVER buy checks through my bank again. OUTSTANDING VALUE FOR YOUR MONEY!! I'm so impressed! I will definitely purchase again.

Nice, sharp, clear printing!!! Quality paper & service tops it all off.... Don’t pay banker’s rates!!!!

This was the first time ordering checks at check o matic, I had a lot of questions. The live chat was very helpful. Thank you for making the process easy. i will be using for more orders.

So easy to use!!! Superb Quality on the color logo printing! this was my first time ordering, but won't be my last!

Our order came in a nick of time and they're excellent! I chose the Burgundy Marble background which makes the black printing show very nicely. We'll definitely be back for more... THANK YOU!!!

Great new layout, easy to order

I will definitely order again from checkomatic!! Super customer service. Fast turnaround!

THANK YOU THANK YOU THANK YOU THANK YOU THANK YOU THANK YOU

How can i review my order? Email: [email protected]

GOOD AND VERY NICE GOOD AND VERY NICE GOOD AND VERY NICE

I will definitely order again from Checkomatic!! My order arrived very fast!! Customer service was very helpful!

Quality is great!! Order arrived perfect. I will definitely order again from check-o-matic.

We ordered these a couple years back, and then again recently. The quality is great and price is competitive. Our order arrived on time and in good condition. I would recommend this company to any business that needs quality service with decent pricing.

We own a rental company and needed more professional looking checks. I've never bought checks online, but please --if you're like me, DON'T hesitate to do it! So much cheaper than the banks and just the same quality. My checks came out perfectly. Love that this is another option to use rather than paying an arm and a leg at the bank.

We own a rental company and needed more professional looking checks. I've never bought checks online, but please --if you're like me, DON'T hesitate to do it! So much cheaper than the banks and just the same quality. My checks came out perfectly. Love that this is another option to use rather than paying an arm and a leg at the bank.

I’m so impressed with these checks because they are nearly identical (they may be identical!) to the checks I used to order from the bank but at a fraction of the cost! These are awesome, they look completely professional, they are thick paper and look fantastic. An incredible bargain for how many you get!

Great value, totally legit checks, business style, customizable, and business size. Would, and already have, recommended! Thumbs up! Order is perfect and wonderful customer service!

Great value, totally legit checks, business style, customizable, and business size. Would, and already have, recommended! Thumbs up! Order is perfect and wonderful customer service!

great product. professional and reliable

great and professional.definitely recommend

reliable and really good quality and professional checks. definitely worth very penny!!

am just trying this i hope this work and deliver as i wanted

Excellent business sized checks! The combination of quality and service makes these my favorite product and place to shop!!! Will be a repeat customer...…

I LOVE my purchase! I had a great shopping experience here... the customer service is absolutely phenomenal!!!!! Try them... you will be super pleased!

surgery surgery surgery surgery surgery surgery surgery surgery

Check o matic did a great job. I am re-ordering with them.

Check o matic did a great job. I am re-ordering with them.

The order was delivered in a timely manner and I am satisfied with the quality and price. Thank you very much!

My entire order was great! fast shipping and great customer service!

We are Very, very happy with your service! Would certainly recommend and order again.

This is the first time I’ve ordered from Checkomatic. I received my checks and deposit slip book, which met my expectations. I also received them in a timely manner. I am completely satisfied with my order and experience at this point. I also liked that you included two envelopes with the checks.

The checks I ordered were received as promised. They look great per the design I choose via your website and were delivered in a timely manner. Thank you and greatly appreciated.

We received the checks in a timely manner and they work great for my business. very neat and up to date. Thanks for your great customer service.

I\'m so happy that i found these checks on your website, they are perfect for my business. slim and neat, yet are business sized! thrilled with my purchase. Thank you!

We received the checks and you did a good job – thank you!

Thank you so much for a Quality product. I\'m very happy with my checks. they work great with my software.

Thank you. The product and service is excellent.

Thank you so much for your great customer service and prompt delivery!

Everything with the order was perfect as usual. We have been using you for over 10 years now and have always been satisfied with the product, price and customer service. Job well done!

My check order arrived fast and work great!

We got our checks and they seem to be exactly what we need at a good price.

The order is right this time :) We are very happy with the way the incorrect order was handled and how quickly it was resolved. Thank you! and we will continue to use you guys :) Have a great day!

everything in my order is great! thank you!

Thank you checkomatic for your great products. I received my order just as i anticipated.

I was very happy with my order and the service. As usual, everything arrived as expected.

I would recommend CheckOmatic! I needed business checks quickly, and CheckOmatic provided excellent value and speedy service, all with my company logo! They\'re great!

These checks work great for me! I have a small business and didn\'t want the personal size checks, but I do like to carry around my checkbook with me. This was the perfect solution. The checks arrived timely and are good quality.

These checks are compact, neat and slim. I ordered them for my new business and made the right choice! they arrived faster than promised. and work perfectly. Thank you!

Perfect checks, fast shipping. thanks!

The service was excellent, the advice of the lady taking the order was quite good, and the product was just as expected. Thank you.

I received the checks, and they are perfect! Thank you

The checks came in perfect and fast. thank you!

Wonderful service, thank you very much!

Thank very much for the email. Everything worked out great! We will be ordering in the future. Thanks.

Thank very much for the email. Everything worked out great! We will be ordering in the future. Thanks.

The checks came in on time and they are fine. Thank you!

My checks look great! thank you!

We received the checks and they are perfect! I’m very happy with your work Always you are very nice and understandable. I will continue to work with Checkomatic.

I have used CheckOMatic services for my company and all condo associations we manage. It is not only the competitive prices, but also the dedication I feel that you put in our businesses. It reinforces my confidence in you as I also have to respond to other. It is like a chainlink. I was surprise to find that you also provide stamps. Thanks for All You Do for us in a very efficient manner and Thanks also for a excellent well-written email to us. It is quite motivating indeed!! Thank you!

We got the checks and all is well. You guys delivered my checks on time as promised.

Great value, Secure and a Quick delivery! very clear and clean checks with a lot of space to work... Totally recommended....

The checks arrived in a very timely fashion, as I’ve been accustomed to. Thank you!

Order received...all looks good. Thank you!!

I am very happy with your product. It has great quality & great prices. Thank you!

My checks arrived fast and just as ordered! Thank you!

I was very satisfied with your service.

checks were exactly what I had ordered, nice fast service!

I have used you several times before and have been happy with my orders! Thank you.

I have been using Checkomatic for several years with good success on the products. Thank you!

Checks look great and got here fast!

I am very pleased with my order. The checks arrived very fast!

All good as usual- thank you!!!

Everything is great! Very pleased as always!

I appreciated the prompt service. Thank you!

Great Company To work with Very Professional. I have Ordered Checks for my Friends and they are very Happy

Checks came out great! Thank you

Love love this company and I will continue to use Checkomatic.

WE ARE ALWAYS WELL SATISFIED WITH YOURE PRODUCT. ITS SO EASY TO REORDER, THANKS

PLEASE THIS IS THE FIRST TIME AM USING THIS COMPANY TO ORDER A CHECK FOR MY COMPANY I HOPE IT GOES SUCCESSFUL, THANK YOU AND GOD BLESS

The means of this business checks manual type is really great and kudos for shipping being so fast

Hello Good day i was introduce to this check production site i hope this site will make my business more comfortable by paying my workers with the check, Thanks ones More

Thank you for your good customer service. I told Checkomatic my problem (we were almost out of checks) and I was given multiple, reasonable solutions.

Absolutely phenomenal service!!! I was completely astonished with how fast these arrived :)

Ordering through CheckOmatic was and always is very quick and efficient. It only takes but a minute or two to order which is great. As many times as I have ordered, I never had any issues processing the order. I have never had any problems with the print on the checks being incorrect. The customer service has always been great!!

I\'m very satisfied with my order. Thank you!

Thank you, everything is wonderful.

Overall, I\'ve been extremely satisfied with checkomatic

we love the checks. I will refer you and use you for my next order.

I was definitely happy with the checks and the service.

Great product, Thank you very much!

The checks are very neat, and are good Quality, I use it for my small business.

I am extremely satisfied with your service. The checks arrived promptly and the info was correct.

These checks work perfect for my small business. Great Quality, and fast delivery!

The checks came timely and are very high Quality, I would reccomend these for your new business! Thank you.

These checks work great with my software. Thank you for the excellent service & fast shipping.

I have used them few times and the process has been amazing! Thank you!

The checks so far were printed correctly. Looking forward to our continued business relationship. Thank you!

I am very satisfied with these checks!! I appreciate your service, quality and value of your products. Thank you!

Our checks were great! Prompt delivery!

I already use this site for another companies. The price, quality and time to delivery is satisfactory.

No words..... A+++++

The checks have a great look to it!

Love yalls services. Thank you

I love this check company thank you so much

I am very happy with the manual checks ordered with Checkomatic.com thank you so much

I am very happy with service of Checkomatic for the Business checks 3 on a page. Thank you so much for your support

Thank You for the quick service

Checks are a necessity, why not do it the easy way with such an easy to navigate website and you get quality checks! I would totally recommend

I am so happy to see you guys are doing good job in printing and shipping out on checks ASAP.

Great service and excellent quality.

LOVE THE PRODUCT, GREAT QUICK SERVICE

Business Checks on Top is a great choice!

Reliable Company, Great Price, Fast and Easy Service

The means of this business checks manual type is really great and kudos for shipping being so fast

I find this company on the web and looks like its pretty good

THX for the fast delivery of our business checks order, works great with our Peachtree software, love the marble background too!!

Very easy site to order, and I love the quality of your business checks, I had a couple questions about adding our business logo to the checks and customer service was more then helpful.

Very efficient website and great quality business checks provided

Very Fast shipping and works great

Check O Matic is very easy to order, These checks with our company logo looks nice and work great with our software.

Excellent quality business checks, would keep coming back to your company Thanks

The step by step instructions when ordering Business Checks from Check-O-Matic were really clear and easy to follow, customer service was most helpful every step of the way. THX

Great website and customer service, quality and prices of your business checks is outstanding. ALWAYS on time proofs and deliveries. Thanks.

This is my first time to order from Checkomatic, after doing my research and found your price was fair. The checks, quality is also great, and I really like our company logo on it Thanks.

All other Software Compatible with Check in Middle laser checks Listed Alphabetically: Accounting by Design American Contractor ACCPAC Plus,6.0,6.0A Accounting by Mac Accounting by Windows At Once (Peachtree) Business Edge Bass Business Vision CDE Central Computer Versa pro.4.0 Checkbook Solutions Chesapeake Champion 1,2 Checkwriter Version 4.0 Cheque-Mate Construction Management CSS Creative Software Crystal Accounting Dac Easy 4.1,4.2 Dac Easy 4.3,4.5,5.0 DSS Assoc.Payroll Companion Finance Manager 2 Great Plains Software 6.0,8.0 Great Plains Dynamics Great Plains Profit hcfa Checkwriter International Insta Play Judy Carr & Assoc Key Accounting Software Key Accounting for Windowes Lake Ave. Software Lytle Research Systems MacMoney Version 4.01 MAS 90 Medlin PC-AP/AR/GL/PR/PCINV Micro Info. Products Microsoft Profit Money Counts Money Matters One-Write Plus 3.0,4.0,4.5 Phoenix Phive P/R &Ind.Strengh P/R Professinal Solutions Procare ProLaw Peachtree Ready to Run Accounting Realworld 6.0,7.0 Redwing Business Systems Solomon 2 Series 6.0 SBT Series 7 Payroll 7.10 SBT Series 7 Payroll 7.10 SoftPro Solomon Series 3 up to 8.0 Solomon 3 & Profitwise 8.0 Swift Professional Accountant Sybiz International Account. for Wind. Total Accountant Transoft The Plus TRAC Star Takin care of Business

All other Software Compatible with Check in Middle laser checks Listed Alphabetically: Accounting by Design American Contractor ACCPAC Plus,6.0,6.0A Accounting by Mac Accounting by Windows At Once (Peachtree) Business Edge Bass Business Vision CDE Central Computer Versa pro.4.0 Checkbook Solutions Chesapeake Champion 1,2 Checkwriter Version 4.0 Cheque-Mate Construction Management CSS Creative Software Crystal Accounting Dac Easy 4.1,4.2 Dac Easy 4.3,4.5,5.0 DSS Assoc.Payroll Companion Finance Manager 2 Great Plains Software 6.0,8.0 Great Plains Dynamics Great Plains Profit hcfa Checkwriter International Insta Play Judy Carr & Assoc Key Accounting Software Key Accounting for Windowes Lake Ave. Software Lytle Research Systems MacMoney Version 4.01 MAS 90 Medlin PC-AP/AR/GL/PR/PCINV Micro Info. Products Microsoft Profit Money Counts Money Matters One-Write Plus 3.0,4.0,4.5 Phoenix Phive P/R &Ind.Strengh P/R Professinal Solutions Procare ProLaw Peachtree Ready to Run Accounting Realworld 6.0,7.0 Redwing Business Systems Solomon 2 Series 6.0 SBT Series 7 Payroll 7.10 SBT Series 7 Payroll 7.10 SoftPro Solomon Series 3 up to 8.0 Solomon 3 & Profitwise 8.0 Swift Professional Accountant Sybiz International Account. for Wind. Total Accountant Transoft The Plus TRAC Star Takin care of Business

These pocket checks are very easy to use and of great quality,

185 Customer Reviews

Add new review

Accepted by the world’s leading banks