Quickbooks Checks 3 on a page First time ordering and I am super impressed with the quality of the checks. No issues with delivery. I will be ordering again!

Quickbooks Checks 3 on a page Affordable and efficient. My go-to business check printer.

We use CheckoMatic for all of our check needs! They have great prices & we receive our products in a timely manner!

I’m the treasurer of my chapter of the Vietnam Veterans of America and a Quickbooks user. I ordered the voucher checks. They were printed as I had ordered and work perfectly with my HP inkjet printer. The checks arrived as promised and in perfect condition. I got 500 checks for less than half of what the bank wanted for 200!

ASJ Wilson Construction has been a client of checkomatic for some years now and they've never disappointed this company. Thank you checkomatic for all that you do.

Been with them for 15 years. Always reliable, always good quality, good service. What more can you ask for?

Came in a timely fashion with no mistakes.

Everything came correctly and quickly. Thanks for everything!

Ordering was easy and the checks came quickly. So much cheaper than other companies I have used.

Wallet/Personal Quickbooks Checks The checks are compatible with my QuickBooks, as promised!

Easy to use. Item was of the most super quality! Immensely exceptional delivery. The packaging was very nice.

Good price for this kind of the check paper, and I used it for printing, good printing quality.

We do payroll processing out of our office and these checks work really well.

I am a new client and couldn’t be more pleased with the customer service, the quality of the checks and the promptness of the order with Checkomatic! For over 33 years, I have been buying my business checks through another well-known vendor. I can’t even fathom the money I would have saved if I had gone with them sooner! Hopefully will be doing business with them for another 33years! I highly recommend Checkomatic!

Quickbooks Checks 3 on a page Great Company! Staff with good customer service! Recommended 100%

Excellent Job including rush delivery. Thank you.

Great product, reliable and fast delivery.

Quickbooks Checks 3 on a page Representative Etty was very helpful and patient! 5* Thanks!

We love the swift delivery of our order. Checks work perfectly with Quickbooks. Good quality.

Quickbooks Checks 3 on a page I've ordered checks three times and each time CheckOMatic delivered perfectly and on-time. You can't beat their quality, price and timeliness

Fast quality checks that I can print with my online QuickBooks. It took like three days for me to receive them after a place my order, super fast shipping an amazing price.

Everything you like when you order Great Price, Fast service, Nice print and color,

The smoothest check ordering process!

Super service from choosing the right check to prompt delivery!

As a small business we use Quick books online for our software and needed business checks to use with our program. Checkomatic checks work perfect and are much cheaper than ordering checks through Intuit Quick books. Thank you for the great professional checks at a great price. Great choice of colors and designs also. Very fast processing & shipping also.

Wallet/Personal Quickbooks Checks Turnaround time like no where else!!!!!! Wonderful customer service who are actually there to help you... Thank you Check-O-Matic! 👍👍👍

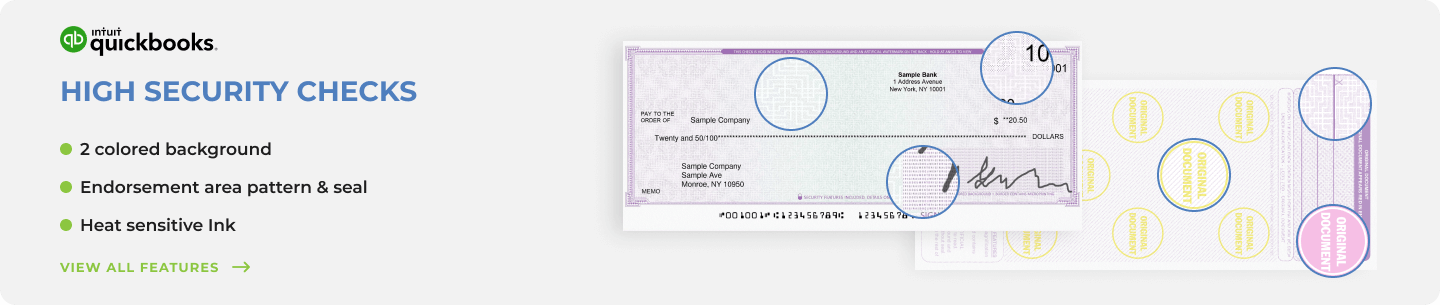

Between all leading brands-Checkomatic excels! I've tried most of the other company checks and the quality and personal customer service you get here... you wont find anywhere! As a matter of preference, I do go for the High Security option which gives you better quality checks and more security features. It's worth the little extra money... Thank you Check-O-Matic!

Quick professional service

You can totally tell that Check-O-Matic care about their customers. They work diligently to make sure that you are completely satisfied. Would highly recommend this company.

Wallet/Personal Quickbooks Checks These checks come in very handy... You always need some checks... I would recommend Check-O-Matic to everyone! This is a company you can REALLY rely on... Trust me!

Quickbooks Checks 3 on a page I recommend Check-O-Matic to anyone looking for professional checks at a reasonable price! Thank you, Checkomatic!

Quickbooks Checks 3 on a page "I've tried so many companies offering check and envelope printing. I am so happy I finally found Check-O-Matic where you can really reply on Quality and Service!!!!!!!!!!!Thank you again and again.....

I ordered these checks after reading many good reviews!! And--Here I am posting yet another 5+ star review! Give them a try! you will not be disappointed!!! I will DEFINITELY order these checks again!!!!

Quickbooks Checks 3 on a page My only complaint is I wish I knew about these sooner I could have saved a lot of money.

Quickbooks Checks 3 on a page Just PERFECT! I did not have to change anything in the default setup in quickbooks for them to print and show correctly though the envelopes. The ordering process was very straight forward

Great Company!! Super Fast Turnaround!

Quickbooks Checks 3 on a page I was pleasantly surprised when I found that nothing had to be changed in the printer setup. 3rd time ordering these checks. I use them for my personal & business accounts with Quicken. Also, the price is very reasonable. Great job folks!! Thanks.

Go for the High Security check stock. Just feeling the paper tells you it's TOP OF THE LINE!! Don't hesitate between the regular or high security The Higher security pays to purchase. Quality is OUTSTANDING!!!!!!!!!!!!

I just received my order today and I have to say WOW!!! GREAT OPTION FOR QUICKBOOKS USERS!

CheckO Matic checks are awesome and affordable will always use them.

I have been ordering from Check O Matic for years. I have never had any issues. The prices are the best I have found. I have, and will continue, to recommend to my friends and business associates

Great company to deal with! Customer service was great! Super fast turnaround.

Super Product!! Customer service was great!! I will definitely be ordering again.

Quickbooks Checks 3 on a page Super Item!! This company has great quality product, great prices, and SUPER customer service! Will definitely be ordering again!

We tested many leading brands for our Quick Book Check on top... This company excelled with their customer service and quality products!! Delivery was even faster than expected... Would advise these checks for all businesses! We will definitely order again!

Easy, worked great, cost effective, helpful online - easy chat made it really simple. Thanks

Although some of the customer service agents are not very friendly or easy to work with, Shaindy was great and helped me figure out how to send back my package and get a full refund. I very much appreciate this, thank you Shaindy! Chelsi

When the website makes a mistake on an order, it should be taken care of. I do have a confirmation email for the wrong amount but I did not realize I could change it from the confirmation email. I ordered 300 and received 1200 and Check-o-matic will not refund the full amount including shipping. This is very bad business coming from a website accredited by the Better Business Bureau. I'm not sure how the amount of checks changed from 300 to 1200.

Love your product and quick service

We ordered these a couple years back, and then again recently. The quality is great and price is competitive. Our order arrived on time and in good condition. I would recommend this company to any business that needs quality service with decent pricing.

You were great to work with and we probably will again as need arises in the future! Thank you very much!!

My entire order was great, The checks work perfect! fast shipping and great customer service! Thank you

Quickbooks Checks 3 on a page I\'m very pleased with my order. Customer service and shipping speed is excellent! Thank you!

GREAT !!! NICE WEBSITE GOOD PRICES THANKS

GREAT !!! EXCELLENT SERVICE AND GOOD PRICES THANKS

GREAT !!! EXCELLENT SERVICE AND GOOD PRICES THANKS

Quickbooks Checks 3 on a page We had ordered directly from Quickbooks for many years, which are very expensive. These were less than half the cost and have functioned just as well. Will continue to use these for our other accounts as needed.

I can't wait to have my check.

Thank you for your great service and quality products!

Received checks in timely fashion and they were perfect as they always are. I like that the order form is in the bottom of the box so when I’m out I’m not searching for phone and order numbers. It’s all right there! So takes less than a few minutes to reorder. Thanks again for great service.

Quickbooks Checks 3 on a page We received our order and are happy with the checks. The logo we added turned out perfectly!

We appreciated the great customer service you delivered when our checks were so time sensitive. The product turned out great. Thank you!

Quickbooks Checks 3 on a page Our checks arrived and look great as always. Thank you!

Wallet/Personal Quickbooks Checks Thank you for the beautiful checks! works great and arrived on time..

My order is perfect. I paid more for rush and received them the next day as promised. Thank you very much!

Quickbooks Checks 3 on a page I am always very pleased with my orders from checkomatic. Thank you!

Wallet/Personal Quickbooks Checks I am completely satisfied with my order. The checks look great!

I received my order promptly. The checks look great! I spent the extra $$ to have my logo in color added and it came out beautifully. Very professional company. Will order again!

Very pleased with my order. checks came on time when i needed them. Thank you.

Thank you for the easy ordering. my checks and deposit slips arrived and they are just fine.

Quickbooks Checks 3 on a page My order arrived on time! and checks look very good. thank you

Wallet/Personal Quickbooks Checks We love your service, product, and pricing. Great job guys!

Ordered first order was great! Then Second order 8 days later with rush processing and still not shipped!!!!!!!!!!!!!! Not very happy. Called and Closed on a Monday????

Quickbooks Checks 3 on a page You guys is good and fast, good work..

Thank you so much. Your quality, efficiency, pricing, and service is so superior to all others I have tried. I am a total customer for all my check needs. This was my first order and was so surprised by how easy it was to order my checks and the cost. I did not expect the exceptional quality of the checks when they arrived. Totally blew me away! Thank you so much.

Everything was handled and sent out pretty quick! keep up the good work.

Quickbooks Checks 3 on a page Thank you for your great products.

Wallet/Personal Quickbooks Checks I am very satisfied with my order. Thank you

Quickbooks Checks 3 on a page My checks turned out even better than I had hoped. You can definitely count on me being a return customer!

Thank you for continuing to offer quality checks. We have been satisfied and hope to continue to order from CheckOMatic.

Wallet/Personal Quickbooks Checks My checks arrived timely and are good Quality. Thank you!

We were very satisfied with our order. It was extremely easy to place the order. I know my company has done business with Checkomatic for a long time, however I am still fairly new here and this was my first time ordering. I don’t remember who I spoke with to place the order, but she was very helpful and provided me awesome customer service. I was also very happy with how fast the checks arrived. Thank you!

Wallet/Personal Quickbooks Checks Just wanted to let you know that i am very satisfied with my order. The ordering was fast and easy. The delivery was on time. Thank you again for all of your help in ordering these checks.

Thank you for the rush order, I was really impressed!

service and quality was great! Thank you!

Quickbooks Checks 3 on a page Very happy . great quality great prices . good service . Thank you!

Quickbooks Checks 3 on a page My checks arrived fine. You did a great job! Thank you

Quickbooks Checks 3 on a page my order was great. Thank you.

Wallet/Personal Quickbooks Checks everything looks great, thank you!

Wallet/Personal Quickbooks Checks I\'m very happy with the check order. Thank you!

Quickbooks Checks 3 on a page Using them over 20 years, great value and service!!

We have for years been happy with the ordering process online and the quality of stock received timely.

We are and have been pleased with the service and products we receive from Check-O-Matic

Quickbooks Checks 3 on a page I\'m very happy with my checks!

I just wanted to say thank you! I had ordered a rush because I needed checks badly. I was supposed to receive 50 checks and envelopes the next day, followed by the rest of the order, but I received the 50 checks and then the whole order later the same day! All 2500 checks and envelopes! Everything was correct works just fine. Thank you for the excellent service!

I\'m very pleased with check order. Thank you!

Quickbooks Checks 3 on a page Everything came in correct. I am very pleased with my order. Thank you!

Wallet/Personal Quickbooks Checks Very satisfied I will be placing another soon. Thanks

Everything was just perfect with my order. Thank you!

Quickbooks Checks 3 on a page I received my checks, and I am very happy with them! Thank you!

I am very satisfied with the service I receive from your company. It is easy, online, and appreciate the reminders also. I enjoy doing business with family owned businesses as that is what I have. Thanks for all the great service you provide.

The checks and deposit books are just fine, and I look forward to ordering again in the future.

My Checks look perfect! Thanks!

Quickbooks Checks 3 on a page My checks look great, thank you!

We have ordered checks for years and I have always been pleased with the product quality, speed of service & fair pricing. Recently I worked with Malky to design a new business envelope. I received several proofs until we achieved exactly what I wanted. Customer service was always prompt and courteous. And the price was quite a savings over our previous supplier! Job well done. I would highly recommend this company.

I am VERY SATISFIED with the checks that I received from you! They were correct... not a problem with them.

Quickbooks Checks 3 on a page The checks are perfect! They shipped very fast too. Thank you!

You guys are the best! We appreciate your quick service and great products! We will be back. Thank you!

Checkomatic has never let us down. We have been with them since we started our business in 2010. Never had to change a thing. Orders are 100% perfect. Won\'t use anybody else for our checks.

Wallet/Personal Quickbooks Checks Your product and service is excellent. My go to for check/banking form needs!

Quickbooks Checks 3 on a page Thank you so much! We are very satisfied with the checks.

I have been completely satisfied with every order I have placed. I am extremely pleased that I am able to order small quantities of business checks. Thank you

I love the customer service! You deliver early, and exceed expectations, I am a satisfied customer!

Excellent product, lined right up with QB and was delivered promptly. Great pricing too!

Quickbooks Checks 3 on a page This is my 3 order and I have been very satisfied with your products.

I am 100% satisfied, Thank you for all of your help!

Quickbooks Checks 3 on a page I am 100% satisfied and more than amazed how fast my delivery was made. I ordered the day before Thanksgiving and received the checks the Monday after.

I have been ordering business checks and deposit slips from Checkomatic for 5 years. The quality is great! Their service is great! Everything always arrives on time or even early. Hassle-free!

I love these checks for my business. The Quality is very good, and style is neat. The checkomatic customer service rep was really nice too! Thank you!

Wallet/Personal Quickbooks Checks My checks arrived timely, and work great with Quickbooks! Thank you.

Quickbooks Checks 3 on a page These checks are very good quality and they work great with QuickBooks! Thanks for your excellent service!

We have been very pleased with Checkomatic.com’s prompt service. Our orders are always 100% correct and on time at a fraction of the cost of other providers. Thanks for your commitment to excellence!

The checks are perfect! Ordering from Check o matic is easy and efficient. We come to you for all of our check and deposit needs. Thank you so much for caring about your client to make it a smooth and easy ordering process. We appreciate you!

Quickbooks Checks 3 on a page satisfied with the product process on time prompt delivery nothing more to say at this time

I have been using CheckOMatic for quite some time. I manage an office that owns 8 fast food restaurants and each one has to use a different bank. Every order I have placed is perfect, and on time. I would like to see more check samples and colors to choose from, however, if not, I would still use this company. I also order all my deposit slips and stamps from CheckOMatic. Lees expensive than banks. Thank you CheckOMatic for your dedication to excellence and to customer service!

Thank you for such a great item.. Super quality

Very pleased with QuickBooks! I ordered checks late yesterday afternoon and received them early this morning! Will definitely use them again.

Ordered Quickbooks checks on top multiple times with this company. Great service and excellent quality!

Quickbooks Checks 3 on a page They are terrific!! Great service, arrived quickly! Printing was nice!

Quickbooks Checks 3 on a page Checks are very nice looking. The order process was painless and they arrived right on time. We're a small business so 600 checks will last us for quite a while. If we ever run out will definitely order again.

Quickbooks Checks 3 on a page Nice checks for the money - I have ordered before and have been very happy. Thank you.

Great experience with checkoamtic.com. We ordered our company's QuickBooks checks here, the website was quick and easy and delivery was very prompt. Thank you Check O Matic!

Great experience with checkoamtic.com. We ordered our company's QuickBooks checks here, the website was quick and easy and delivery was very prompt. Thank you Check O Matic!

This istest review, please ignore it This istest review, please ignore it

This istest review, please ignore it This istest review, please ignore it

This is review textThis is review textThis is review textThis is review text

This is review textThis is review textThis is review textThis is review text

I like this product. I use it for 2 business\'. Thank You for correcting the perforation.

Great quality and service, a pleasure to work with! Will definitely will reorder again.

Great item! Thank You

Checkomatic's pricing can't be beat. Their service is excellent and the shipping is fast. Two thumbs up.

Was an easy experience, thank you!!!!

Great!

Wallet/Personal Quickbooks Checks Great checks that print alright with my quickbooks, very good customer service and quick shipping

Checkomatic offers The best rates I could find online. Checks align perfectly with QuickBooks pro 2014, Thanks

THE LOGO ON THE CHECKS ADD A VERY PROFFESIONAL TOUCH TO IT, QUICK TURN AROUND, HIGHLY RECOMMENDED.

great deal on these quickbooks business checks. thank you

I've been using Check-O-Matic for several years and have been very pleased with their products, pricing and promptness. (How's that for an alliteration!) I do wish there were more choices for check designs. I like to change with each new order and have gone through all the choices several times.

Wow! What great service. Ordered my checks on 1/16 and got them the next day. I\'m very happy with this company and will be back to order again. Thank You for the fast service. Customer support also was very helpful. I will recommend you to other people looking to order business checks. April M NY

I ordered two days ago, order arrived today. (1) perfect (2) special printing request fulfilled (3) order arrived well before expected. You guys are great, I will order again in the future (both personal and business), and I will recommend you to my clients. Thank you!!!

I ordered two days ago, order arrived today. (1) perfect (2) special printing request fulfilled (3) order arrived well before expected. You guys are great, I will order again in the future (both personal and business), and I will recommend you to my clients. Thank you!!!

Excellent service. I\'m a loyal Checkomatic customer and for good reason, their business products and QuickBooks checks are of best quality and shipping is always fast and on time

Excellent service. I\'m a loyal Checkomatic customer and for good reason, their business products and QuickBooks checks are of best quality and shipping is always fast and on time

I really like the quality of these QuickBooks checks! On my last order I\'ve decided to add a COLOR logo instead of the free black and white, and it looks just amazing! Great customer service as always. Thx

I've used this checks product for several years now and I've always been very satisfied as its very easy to set up with QuickBooks Checkomatic has also provided me with great customer service, I've recommended them to others and they've been happy too

I've used this checks product for several years now and I've always been very satisfied as its very easy to set up with QuickBooks Checkomatic has also provided me with great customer service, I've recommended them to others and they've been happy too

Super Easy to order and reorder.

check o matic is the best , they always deliver top quality products

Customer service is pretty awesome at Checkomatic, the checks are good quality and prints perfectly with our QuickBooks pro 2013 version.

works like a charm with my laser printer and feeder, so no problems there!

I\'ve been ordering our business checks with Check O Matic for several years now and I am always pleased with their quality and ease of ordering. Checks arrive quickly and very well done.

Quickbooks Checks 3 on a page This was a very easy process, Thank You!!!!!!! I have looked around for better pricing, but you have them topped. I do however wish the colors were better. I am a very big purple fan and your company did not offer this as an option for the checks I ordered. But thats okay, maybe next time. Have a great day!

Quickbooks Checks 3 on a page Great checks. They work well, look nice, and function smoothly with my Quickbooks application.

Excellent company to order from. I\'m very satisfied with these quickbooks checks ordered here. And they arrived well before I expected them. I definitely suggest you order with checkomatic.com

I received the checks on time, but I noticed an error in the spelling of our business name (it is a common mistake, so I always look for it). I called and they said, \"We\'re sorry, we\'ll take care of that right away.\" I just receive the new checks - in about a week - everything was great. Thank you - I will definately do business with CheckOMatic again. Lynne Foss Office Manager Shelden Architecture